For decades, the world ran on a deeply internalised assumption: the United States is ultimately in control of the world order, of history’s direction, and of the dollar.

In 2025, that assumption finally collapsed. Trump’s handling of the trade war and Ukraine didn’t just spook allies. It forced a long-delayed thought into the open: what if the system’s guarantor is no longer reliable or predictable?

People didn’t say it out loud. They just bought metal.

Gold, silver, platinum, and copper rallied from one all-time high to another, and with no end in sight. It was a clear vote of no confidence on an epic historic scale.

This is one strange thing about 2025: events of genuinely historic magnitude kept happening — and then immediately disappeared. Social-media cycles were so compressed, turbo-charged by the proliferation of AI-generated content, that our minds barely had time to register before attention moved on to the next short video.

The United States bombed Iran’s nuclear facilities. Say that sentence slowly. A few years ago, this would have been considered an extinction-level escalation scenario in many risk models. In 2025, it happened — and then it passed. It was an enormous gamble, and Trump, to his credit, won this gamble spectacularly. Iran backed down. Oil did not spike above $120 a barrel. But what exactly did he win? Peace? Or proof that peace now depends on preemptive bombing followed by social-media amnesia?

Then there was the India-Pakistan conflict, with two nuclear powers, engaging in what may have been the largest aerial dogfights since World War II. Another event that should have permanently reshaped perceptions, yet barely stayed in the global consciousness for more than a week.

The assassination of Charlie Kirk was another moment that should have lingered longer than it did. Many people saw him as one of the last public figures who genuinely believed talking to the other side was not a form of treason. He is now dead. His death marked not just political violence, but the further erosion of the idea that dialogue itself is safe. American polarisation crossed into a darker phase.

Polarisation showed up economically as well. 2025 was the year the U.S. economy visibly bifurcated. One half of it was AI. The other was everything else. Capital, talent, chips and electricity flooded into the race toward AGI, turning AI into the single pillar supporting economic growth and equity markets. At the same time, much of Main Street felt increasingly strained. Long-duration interest rates stayed stubbornly high despite Fed cuts — an ominous signal for the rest of the economy untouched by the love of AI.

But even for AI, we already start to hear nervous chatter about a bubble. Yet, this is the last engine of American growth. It will not stop. It must not stop. The cost of shutting it down would be unbearable. The music has to keep playing.

Doubts about America’s future would not have felt so sharp if they had been offset by disappointment with China. But disappointing, in 2025, China clearly is not.

If 2025 was the year the myth of American exceptionalism finally cracked, it was also the year China decisively broke free from the doom and gloom narratives that had dominated the past few years.

What was striking was not just the reversal, but how fast it flipped. Barely a year ago, China was “uninvestable.” Empty investment conference seats. Sliding equities. Endless variations of the same story: China is peaking. China is collapsing. China is Japan. China is entering “an age of malaise”, poetically claimed by Evan Osnos, long-time China correspondent of The New Yorker.

Perhaps the best personification of this extreme pessimism is none other than my favorite Noah Smith, who pounded at the table and screamed:

China at the Peak! (July 2023)

Will China squander its moment in the sun? (Jan 2024)

(Read my rebuttal to him here)

Then suddenly the script flipped. “A great reckoning.” Dan Wang’s Breakneck became a phenomenal success and, for the first time in living memory, made China a mirror for the US intellectual elites to review itself. A flood of near-identical YouTube thumbnails and Twitter threads: I visited China and was shocked, as if written from the same template.

Admiration quickly morphed into panic. China isn’t just doing well, the story went — China is eating the world. China is too capable. China is unfair. China is making trade impossible.

The turning point had names. It started with DeepSeek and a frenzied few days in late January, causing Nvidia to lose $600 billion in value in the biggest one-day loss in human history, forever killing the previously ironclad assumption that the AI gap between the U.S. and China was vast and unbridgeable. It wasn’t.

The India-Pakistan conflict delivered another unintended demonstration effect. For the first time in history, the world saw Chinese weaponry perform in real combat conditions, and it’s not even the most advanced systems in its arsenal.

In the meantime, China’s surge in biotech was set to replicate its success in EVs and is on track to dominate the world, again. This, along with the stories of China-made diamonds, China-made wine, and even China-made caviar and foie gras, shows that this current wave of China possesses an unstoppable, all-encompassing nature.

And there is even more. The success stories of Nezha 2, Black Myth: Wukong, POP Mart, Rednote, and even luxury goods show the world that this wave of success isn’t just confined to the material world, but also manifests itself in the world of soft powers and intangibles, where China was long believed to be bad at.

At this stage, it seems only high-end chips and top talents are the US’s two remaining edges over China. But the first one appears on track to be over soon, while for the second one, Trump was busy self-sabotaging with visa restrictions and tighter anti-immigrant policies.

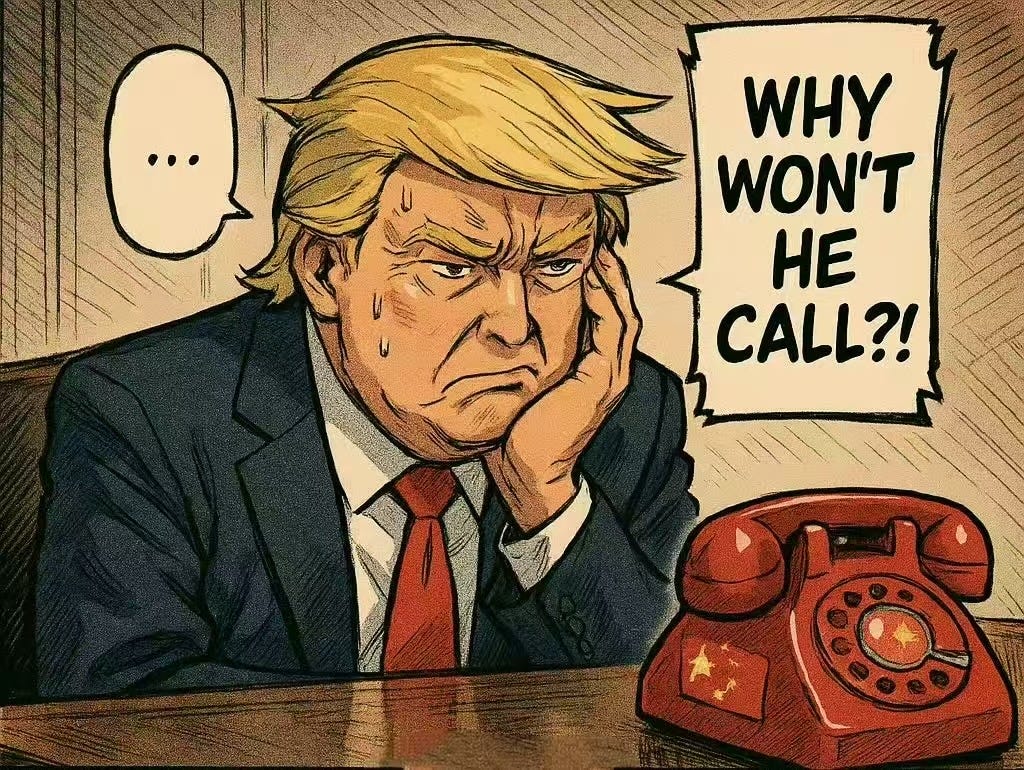

Then there was the trade war. Contrary to expectations, China did not panic. No theatrical escalation. No desperate concessions for Western applause. Just patience, timing and textbook game theory. Watching it unfold felt less like geopolitics and more like a Tai Chi demonstration against a furious heavyweight boxer. Every swing was met — not head-on, but sideways. The boxer thought he’d scored a knockout, then noticed he couldn’t breathe.

(I have to thank Trump and his trade war here, which made me one of the very few China-based authors writing for The New York Times, which is quite an amazing personal experience this year.)

Why did the U.S. miscalculate? At its core, it’s the hubris and self-complacency. A misguided belief in its permanent supremacy, which, in part, stems from what I dubbed “ideological monotony” last year. Just as the same belief has blinded the DC establishment and globalist elites to the woes of ordinary masses, it has also driven the Trumpists to the epic miscalculation that the US still has unmatched leverage.

And why didn’t China cave in? Because it had been preparing. A year ago, China’s emphasis on security over growth was mocked by commentators who saw it as an overreaction or ideological rigidity. Noah Smith attributed China’s peaking to China’s leadership, which wouldn’t give up “their obsession with control.” Wei Lingling claimed that “Xi’s tight control hampers stronger response to China’s slowdown.”

In 2025, the laughter stopped. It turned out that years of self-sufficiency efforts, redundancy building, and belt-tightening mattered. If not for these measures, China could have easily buckled when the real pressure arrived. What was deemed stupid suddenly looks far-sighted.

By the end of this confrontation, a de facto G2 world had taken shape. The U.S. has finally realised it misjudged the balance. In Kübler-Ross's five stages of grief terms, it has already moved past denial and anger, and now drifts somewhere between bargaining and depression, edging slowly toward acceptance. The empire is not yet collapsing, but it is clearly retreating. At home, it is consolidating and re-industrialising. Abroad, it is quietly disentangling from peripherals like Europe and Japan, while staying muscular in its own backyard, to Venezuela and Cuba.

China, however, is not free of risk. As external pressure eases, it may finally gain the strategic space to confront deep internal imbalances. If left unresolved, economic discontent will find a way of mutating into something darker, more grotesque, from both ends of the political spectrum.

Fortunately, we are witnessing clear signals in that direction. If China can pull this off again, we might have peace and prosperity for several generations at least.

With that said, I wish all of you a fruitful, exciting, and happy 2026!

2025 in pictures:

A good comment sent to me by Michael Laske, a long-time subscriber. Posted here with his permission:

Hi Robert,

At times during the last 9 months I became disenchanted with the ideological background of some of your essays and posts, while still enjoying your range of knowledge and analytical capability.

When I think about our times from a global perspective , I constantly witness the pendulum-like movements of ideas and acceptances. The U.S. has, indeed, shifted far to the right and caused tremendous internal and external discord in the process, which will engender a shift back to the left within the next five years. This unfortunate series of events brought about by an immoral, corrupt, but well prepared, MAGA administration was unfortunately predictable. And the prognosis became fact. Few of us like or were adequately prepared for the reality presented to us.

From a U.S perspective, the one positive out of this difficult year was the awakening of the liberal economists to the understanding that production and local sufficiency matters much more than previously considered. Out-sourcing and cost efficiencies were

no longer the only salient factors. How this works its way through the system is a question point.

While I accept and agree with your comments about the US. I think your patriotism sends you off track regarding China, especially the economy. A good stock market after 15 years of stagnation may not indicate a turning point. I have been in China since 1989 and not since 1990-1 have I seen such a downbeat macroeconomy, especially the heavy industrial and mobility sectors. Usually, there is a great spike every fourth quarter, which failed to materialize this year. Chinese companies will now need to balance

overseas and domestic investment and production. Capital will need freer movement and the concerns and requirements of the lender are much different than those of the borrower or home market. Politics and social policy will need adjustment.

China is strong and has provided technology and services and a new model for the world. I have been involved with technical innovation here for over three decades. Still, I wonder whether China has climbed one hill only to find that it requires a new mountain to maintain its momentum. Attention needs to be paid to domestic and social issues. Economic growth and cultural requirements may not resolve the challenges of the next decade. Self sufficiency cannot resolve

the problems of inequality.

Finally, I have believed for about a decade that the U.S.’s problems are China’s problems, which in turn are the main global problems. Climate Change, AI and its consequences, and economic disparity are not going away. Can China and the U.S. work together to establish a useful framework for the future-environmentally, economically, and militarily? Can trust be developed in time?

Frankly, I don’t think much else matters.

Happy New Year,

Mlaske

That's pretty good. I especially like seeing Noah enter a sputtering stage wherein he's made to look the fool he is. The only thing I'd add is the elephant in the room; no one's talking about it. It's so big, it fills the room; there's no room left to talk. To whit...

The incompatibility of liberal democracy with large populations in incredibly complex societies. It's not like no one's noticed it before...Aristotle, James Madison, Alexander Fraser Tytler, Lippmann...they all had on point observations about the inability of US type liberal democracy to handle things. It's not that I don't like the idea of it; I love the idea. But, it doesn't scale.

Mencken described democracy as "a pathetic belief in the collective wisdom of individual ignorance." There've been various examples of this throughout history, but the current situation in the US of A is putting it in stark relief. Compound it with the inherent problem of media conglomerates that have moved beyond the 4th Estate to arbiters of everything, making public service so miserable for anyone in office that only sociopaths find it attractive. Add the internet, designed to accelerate extremist engagement, and it sure seems like we've achieved critical mass for a meltdown. I'm not worried, but I've been in survival mode for the last 50 years. It seemed prudent.

Which is not to say I'm predicting disaster; only fools make predictions. But, the show's just starting. Pass the popcorn.