Hi folks, welcome to a new issue of Week in Review @ China Translated

You would expect to see me reviewing events of the last week(s) that I think carry a long-term impact on China. I try to stick to a weekly publishing schedule but there is no guarantee about it. Occasionally, I also publish in-depth essays, some of which are related to the themes listed in the Master Plan and Table of Core Contents.

#1 Can athletes dance hot dances in China?

A huge controversy surrounding athlete-turned-influencer Wu Liufang吴柳芳 exposed new fault lines of discontent in China.

Wu, born in 1994, is a retired Chinese gymnast. She was a member of China's National Gymnastics Team from 2008 to 2013 and won multiple gold medals at international competitions. However, her gymnastics career ended prematurely due to a severe neck injury sustained during the Olympic trials in May 2012, which prevented her from competing in the London Olympics.

After retiring from gymnastics, Wu pursued various jobs, without much success. In 2024, she transitioned to becoming an online influencer on Douyin (the Chinese version of TikTok), where she began posting dance videos. Her content often featured provocative outfits such as shorts and mini skirts.

The first shot of public controversy started in November when, Guan Chenchen, another former gymnast and Olympic gold medalist, publicly criticized her for "crossing the line" and damaging the image of gymnastics with Wu’s sexually provocative content. This criticism sparked a heated debate on Chinese social media about the appropriateness of her actions as a former national athlete.

According to Dao Insights:

Some netizens agree with Guan and think that Wu’s dancing while dressed provocatively is “vulgar” and that she shouldn’t have used “former national team member” as her account description. Others attacked Wu for supposed “ungratefulness” to leave her job as a teacher after retiring from the National Team and called for authorities and platforms to crack down on all “provocative” and “vulgar” dancing content. Meanwhile, others think it’s her freedom to do whatever she wants as long as it doesn’t violate the community rules of Douyin and that she is not wearing less than when competing as a gymnast.

Soon, on Nov 24, Wu’s account was shadow-banned, unable to be followed, and was barred from posting more content for some time.

However, the soft censorship only made the case even more controversial.

For many people, Wu became a victim abandoned by the establishment. Most of China’s athletes are state employees, but only a few can reach success in their careers, and even among the “successful ones”, only a very few can attain financial success through sponsorships. For most athletes like Wu, how to make a living after their athletics career has always been a problem, similar to how a veteran can adapt to normal life. In such a case, why can’t Wu do whatever it is legal to make a living?

The sympathy surrounding Wu has been so large, that when her account was reinstated last Sunday, her number of followers immediately skyrocketed by millions to as high as 6.3 million in fewer than 2 days. Such a strong public reaction has obviously caught the censors off-guard. Soon, on Tuesday, she was shadow-banned again.

This time, a unique but controversial treatment was applied to her account. Most of the followers have been forced to unfollow, so her number of followers has “dropped” from 6.3 million to a mere 44,000, which according to Douyin was Wu’s number of followers before “infringing on platform rules”.

The censors’s goal here is quite explicit. Obviously Wu is not breaking any laws, so her account can’t simply be obliterated. But at the same time, silencing her for only a limited period of time is not “enough to deter more copycats, because that 6.3 million follower count is power. When she comes back again, she can put that power to good use, spelling a defeat for censors. So the more effective way is to not just silence her temporarily, but “delete” her following as well, in the hope that as time goes by and when nerves cool down, people will forget about her.

This is another instance of evolution for online censorship in China, showing they have been more and more sophisticated with their craft.

But, I feel the censors have made a grave mistake in the beginning, by stepping in and placing the temporary silence ban on Wu the first time, which not only did not quell controversy but even made it bigger.

Overall, I think our authorities meddle too much in private lives. It is ill-advised for them to act in the role of moral police, especially at a time when our economy and society need some more chill and fun. We should be more tolerant of how little people choose to earn a living, so long as it is legal. As for what should be morally appropriate, it should be left to the society to figure it out. Why should the government take the heat?

[The rest of the article will be reserved for paying subscribers for 5 days, in which you will find similar censorship on some high-profile sell-side research analysts, Chinese AI firm Deepseek’s groundbreaking model, China’s recent action against high-sea fishing aka illegal cross-regional law enforcement, and disappointing November retail data.

All paying members of Baiguan enjoy free access of China Translated. Substack does not allow automatic bundling, so please DM me for this free access or if you have double-spent.]

#2 Restricting public voice of sell-side analysts

Similarly ill-advised shadow bans have been placed on some high-profile sell-side analysts. Around 3 weeks ago, the Chinese internet widely shared two separate presentations by two leading economists at sell-side brokers.

One is by Fu Peng, Chief Economist at Northeast Securities, who famously claimed in a recent closed-door meeting that painted a gloomy picture of China’s economy, calling for the distribution of wealth in order to boost domestic demand.

Another one is by Gao Shanwan, who boldly claimed that China’s GDP has been overstated by 3 percentage points annually over the past several years. (Visit Baiguan to see a full translation of his presentation.)

These two presentations had been allowed to be shared quite widely for a few days, leading many people (including me at the time) to wonder why they had not already been censored. The censorship came late, but still came. As of now, the social media accounts of Fu and Gao were “frozen”, unable to be followed, and even unable to be searched.

According to SCMP,

A source from Northeast Securities said Fu would not be making “any public appearances for the time being,” as public “misrepresentation” has caused “considerable distress”.

I am sure the authorities believe that by muzzling the voice of pessimistic economists, they can help create a more “positive expectation” for the market. They might. Narratives are important. Control of narratives might change expectations. But at this stage of our economic downturn, I believe such an act can only make it worse. Some deep rethinking about what the government should and should not do, just like in the case of Wu Liufang above, is needed here.

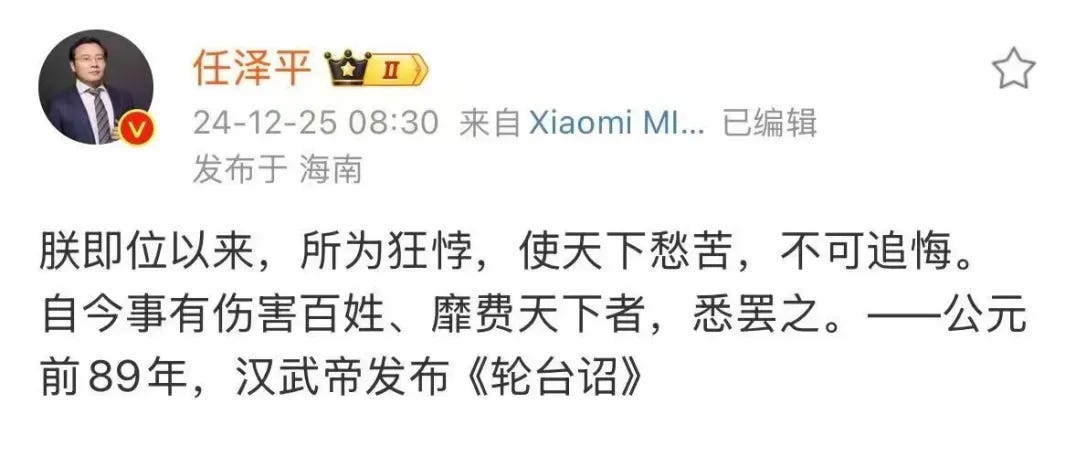

In a perhaps separate event, another famous sell-side economist, Ren Zeping, was also shadow-banned. This Wednesday morning, he posted a cryptic Weibo post, citing a line from the famous mea culpa by Emperor Han of Wu (156-87 BC):

"Since ascending the throne, my actions have been reckless and misguided, causing distress and suffering throughout the realm, which cannot be undone. From now on, all matters that harm the common people or waste the empire's resources shall be abolished."

It's obvious whom he is referring to here. Although he quickly deleted this post, the damage has already been done. By the end of that day, his account was frozen as well.

It's interesting to see private discontent of The Man seeping into the public domain.

#3 State Council vs high-sea fishing

Something more positive to cheer up your holiday mood.

On December 16, the State Council held a study session to discuss making law enforcement in compliance with…laws.

Premier Li Qiang said:

Promoting strict, standardized, fair, and civilized law enforcement is an important part of building a government ruled by law. Currently, abuse of administrative discretion and unfair law enforcement still exist in some fields and regions. Starting from issues that strongly concern the public and businesses, we must further improve the administrative discretion standards system and regulate the exercise of power. Regarding the problem of incomplete coverage of standards, we should promptly improve the discretionary standards for licensing, collection, enforcement, and inspections. Regarding unreasonable discretionary ranges, we should consider business entities' violations and their ability to bear consequences, determining penalty limits according to the principle of "punishment fitting the violation." Regarding inconsistent local standards, we should strengthen overall coordination and guidance, and promptly supervise adjustments.

and that:

We must strengthen law enforcement supervision, paying attention to abnormal increases in fines and confiscation income, large-scale cross-regional law enforcement, and cases of maximum penalties. We should review and verify related law enforcement actions, and promptly correct any issues found.

It’s obvious that he was referring to the endemic “high-sea fishing” that this newsletter has referred to many times.

It’s also interesting to observe that this meeting happened not long after Zhejiang Province, where both Li Qiang and Xi spent major parts of their career in, became the first local government to publicly reveal a case about high-sea fishing.

My wish is that they can punish some of the most egregious cases in order to send out a clear message.

#4 November’s retail data

China’s retail sales data for November was disappointing. Despite the stimulus action starting in late September, retail sales rose only by 3% in November from a year ago, missing the forecast of 4.6% in a Reuters poll.

But overall, I don’t think it’s too bad a piece of news.

First of all, this year’s Double 11 shopping festival started earlier in October compared with last year, so there was a strong front-loading effect. This is why cosmetics, a category strongly associated with shopping festivals, did very badly at -26.4% year-over-year.

Secondly, if we look closely at detailed accounting, we can see that basically all categories that received recent subsidy support did quite well.

For instance, home appliances were up by +22.2%, showing the impact of the subsidy programs. Furniture sales are also up by 10%, suggesting real estate transactions are picking up.

Dining growth was at 4%, higher than general retail 3% growth. Recently, a few cities in China such as Shanghai have been testing out dining vouchers. (I did a deep dive on this at Baiguan.) Dining’s slight outperformance compared with overall retail sales could be attributed to this kind of policy support, which is still quite regionally limited.

In any case, this data suggests consumer support policies work. And if you combine that with the fact that this is not some third-party data, but published by the government themselves, and also with the fact that China is now serious about boosting consumption, you will easily draw the conclusion that most consumer support programs are on their way in 2025.

#5 DeepSeek’s low-cost new AI model

Another exciting piece of news came from Chinese AI firm DeepSeek, an arm of “幻方量化 Higher-Flyer Fund”, one of China’s largest quant trading funds.

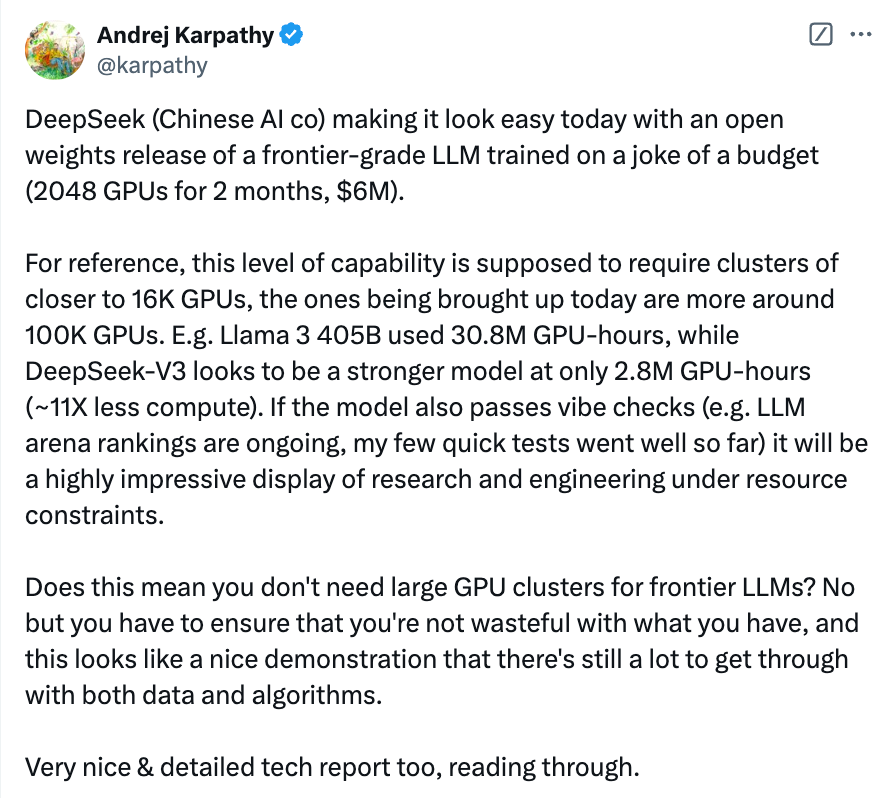

DeepSeek’s recently announced DeepSeek V3 model took Silicon Valley by storm. In layman’s terms, this is a GPT-4o-level model, with a fraction of the cost, and it’s open-source as well so anyone can review its code and install it locally.

Andrej Karpathy:

And I also caught ChinaTalk’s Jordan Schneider scratching his head about it:

Rest assured, Jordan, it is real.

There are several major implications that I can instantly think of.

First, this is bad news for Nvidia. It seems Silicon Valley has been too wasteful in terms of its GPU purchases. You don’t actually need so many GPUs to develop a state-of-the-art model after all.

Second, this is bad news for trade restrictions on China. Scarcity does not destroy innovation. If anything, scarcity only breeds innovation. I have long argued that innovation happens when there is a problem to be solved, and there is also the willpower to solve it.

In Xi puzzled, where are my unicorns!? I wrote:

Innovation doesn’t happen out of thin air. It always requires a thing to innovate on. At the most basic, individualistic, and operational level, innovation requires a problem to be solved. It’s the problems that breed and propel innovation into being.

…

If there are no problems in the world, innovation will stop. Because in a world where there are no problems to be solved, people would be too lazy to do anything about it. It’s as simple as that. And simply because no one can claim a monopoly over problems, no one can have a monopoly over innovation.

Now Chinese people have the problem (technology bottlenecks), and have the willpower to solve them. Who is to stop Chinese people's innovation then? DC trade officials should seriously rethink their China policies.

Third but not least, this is once again a great demonstration of the pattern I observed in the Can China catch up with the US in AI? article, in which I argued (correctly) that China will catch up because the US has already demonstrated that AI is feasible. That act alone has cleared a major psychological hurdle for China. The 0 to 1 stage, which is the main weakness of China, has been passed. After that, Chinese engineers will have the full confidence and all the financial backing to help grow 1 to 1000, which is China’s main strength.

I also argue that:

Maybe it’s America’s comparative advantage to innovate, to break open newer frontiers of human understanding, while it’s China’s comparative advantage to learn, to work diligently, to catch up, and in the process, to scale, so that the rest of the world can access the best technology at the most affordable price.

A world in which the US acts as the top innovator, while China acts as the “master scaler”, the US as the inventor and China as the engineer, the US as the world’s lab and China as the world’s factory, locked forever in a constructive form of competition, is a net benefit for the rest of the world and can be a net benefit for those two super-powers as well.

I mentioned the concept of the Great Divorce in the last post. Maybe it’s time for us to recognize the respective strengths and weaknesses of each party in this great divorce, and to re-formulate a new symbiosis.