Banned by Noah Smith for 100 years, stock markets zigzags, regional GDP targets out, UK pianist incident, Pudong new policy, derivative bombs for retail investors - Week in Review #10

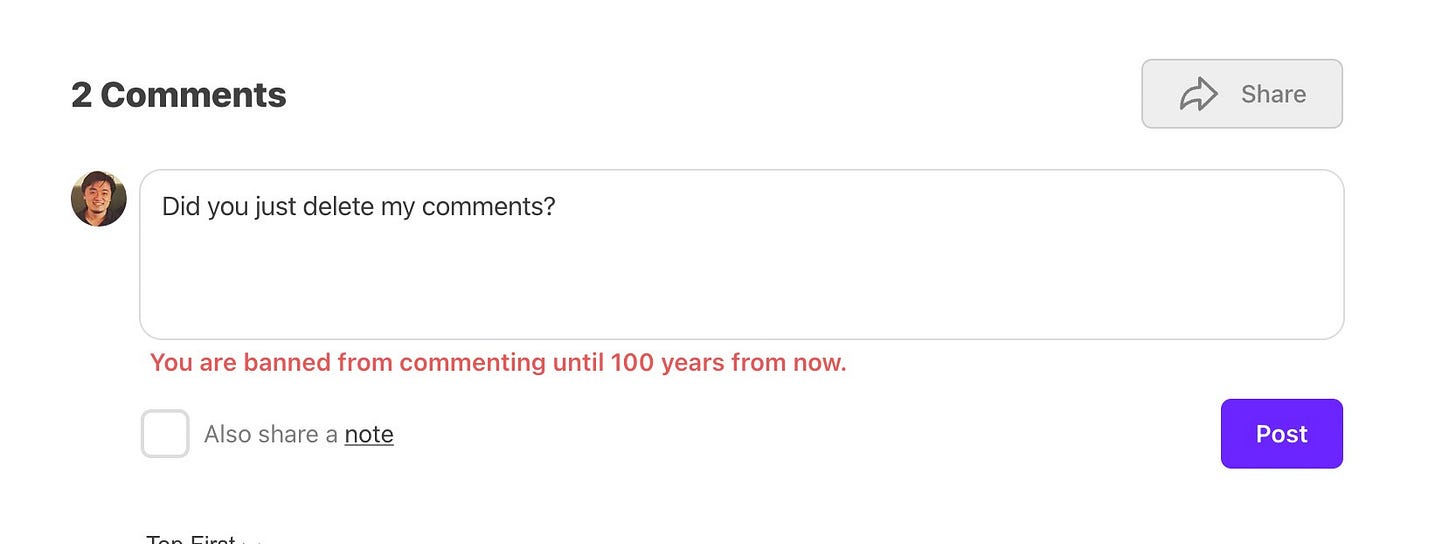

This week, I commented on Noah Smith’s article on Liu Cixin’s Three-Body Problem atNoahpinion. Shockingly, Noah immediately deleted my comment. Not only that, He also sentenced me to a 100-year ban from commenting on his Substack, all despite the fact that I am his annual paid subscriber. (You can judge for yourself if my comment deserves his censorship.)

It’s almost tragic, that despite all the criticisms he has of China, he learns from one of the most questionable practices that China uses: censorship. For China, censorship arguably does serve a real function of preserving social cohesion and preventing hate and chaos. In Noah’s case, however, I am not sure what it does other than protect his thin skin. After all, this is Substack. Unlike many other platforms, this is where well-informed adult people are capable of being engaged in a free and coherent exchange of ideas. Does he unwittingly become the proverbial knight who fights too long against dragons and becomes a dragon himself? (Wait, is that a Chinese dragon?)

I don’t think I can influence his behaviors. But, my dear subscribers, this is my promise to you: I will never, ever do this to you. As a subscriber to me, you are entitled to an equal right to discuss and debate with me. If you disagree with me, tell me. I will try to engage. It also creates a greater public good if more people can see your disagreement. We may never agree, but that’s fine. If you think I am stupid, tell me, and maybe you are right. After all, your comments and subscriptions are a sign that you care about what I am saying. That care deserves my utmost respect.

Also this week, Noah wrote another article on China titled Will China squander its moment in the sun? Surprisingly, I actually find myself in agreement with the majority of his ideas in that article. Still, the fundamental premise of his article is quite misguided. So I think this is something I could write for Part 2 of the "Noah Smith is clueless about China” series. I can talk about what I agree with and what I disagree with.

You may also have noticed, that I am more interested in critiquing Noah as an idea rather than Noah as a person. For me, Noah represents the best articulated thinking a typical American intellectual can get at China right now, and much of his thinking can be not only wrong but dangerous.

So, should I write about it? Poll time!

I will and only will write about it next week if more than 50% vote yes and at least 60 subscribers join the vote.

Now onto the main content, the events of the past week that I think will have a lasting impact beyond news cycles in China:

the profound

#1 Stock markets zigzags on positive messaging and market stabilization fund rumors

Fast-paced sequence of events this week:

Monday: Despite no clear catalysts, China markets continued the freefall. Hang Seng index touched 14794, only a few points away from the low of 2022 in the wake of the 20th Party Congress. The Shanghai index was testing yet another psychological threshold of 2700.

Monday evening: A Singapore-based fund called Asia Genesis shut down because of a wrong-footed “long-China, short-Japan” bet. Its CIO’s depressing mea culpa letter to shareholders was widely circulated on Chinese social media.

Also on Monday evening: Li Qiang chaired the State Council meeting. Discussion about capital markets was ostensibly on the top of the agenda. Premier Li called for more effective measures to stabilize the stock market, representing a rare voice of support for the market from the top leadership.

Tuesday morning: Bloomberg reported that China was considering a $278B market stabilization fund, most drawing from foreign assets from state-owned enterprises.

Tuesday: China markets rebounded violently.

Wednesday: This is the “miracle day奇迹日”. In an unusual move, PBoC chief Pan Gongsheng announced himself (as opposed to a government written statement) that the reserve ratio requirement would be cut, releasing liquidity to the market. In another unusual move, a deputy head of the stock regulator stated that “Only when investors are well protected, will there be a solid foundation for a prosperous market”. China’s capital markets have long been criticized for benefiting the fundraisers/corporates at the expense of investors. (We talked about this before at Baiguan. Capital market reform since 2023, such as restrictions on controlling shareholder selldown, represents a clear pivot to benefit the investor side)

Thursday: Market rebound continued very strongly

Friday: The Hong Kong market fell, while the A-shares stayed put, partially due to a lack of materialization of the “stabilization fund” rumor, and also partially due to the US Congress CCP committee’s newly introduced legislation cracking down on Chinese biotech firms.

The significance? I think we are entering a new phase of the stock market now. The stakes become higher. Clearly, the government is perceived to have made some meaningful commitments to boost the market sentiment. But if not followed through, it would be a major disappointment.

the interesting

#2 A derivative product wreaked havoc on wealthy retail investors

Recently, a structured derivative product called “snowball” has wiped out wealth for some wealthy retail investors and has caused some nerve in China’s financial market

You don’t have to know the exact details of it. Just remember this is a derivative product tied to the stock market and is sold to mostly wealth-to-do retail investors, including a Chinese film star. It has a pretty enticing fixed income return (as high as 15% annual return) during good times, but if the stock market goes below a certain price point, the entire value of the product can be wiped out.

And wiped out are some of the products this past few weeks, as the market keeps breaching historical lows.

As I said before, as economy and capital market sentiments worsen, ugly things are bound to happen. As Buffet said, "Only when the tide goes out do you discover who's been swimming naked." These ugly things form the catalysts for the government to take action.

(Also worth noting is that this episode shows the lack of experience of China’s retail investment community in general. I see investor education as a great business in the decade to come. Retail investors’ knowledge is simply too immature to catch up with the ever-complex financial market, yet both education and earning money (or preserving wealth) are the two favorite hobbies for Chinese people. You can imagine the business opportunities this combo can generate. This week, my teammate Aaron Zhou launched a paid investor education program in the Chinese podcast space. Our aim is not to help Chinese investors make money but rather to identify key risks, develop a better psychological framework, and eventually not lose money.)

the under-reported

#3 Regional 2024 GDP targets out

I don’t see many people talking about it but many provinces in China have announced their GDP targets for 2024. Almost all of the announced targets, including that of Shanghai, are no less than 5%. This suggests the national GDP target for this year could stay at 5%.

It’s a little surprising for me because this will mean China targets to grow our economy at the same rate as last year, which actually benefited from the low base of a COVID-stricken 2022. It seems the local governments are quite confident, either because of the reality that economic sentiments are indeed recovering and/or because of further stimulus policies are being contemplated. We will see.

#4 Pudong Integrated Reform Pilot Implementation Plan 2023-2027

After Shenzhen, Shanghai’s Pudong New Area became the second locality to receive the second so-called “Integrated Reform Pilot Implementation Plan综合改革试点实施方案” from the central goverment. The key word here is “pilot”, as successful reform pilots will have the potential to be replicated nationwide.

I will not go through this plan item by item. Just remember the key spirit of this document is “openness”. I will just quote some parts that I think are quite audacious in today’s setting:

探索在浦东新区注册的涉外商事纠纷当事人自主约定在浦东新区内适用特定仲裁规则,由特定仲裁人员对有关争议进行仲裁。Explore the establishment of a mechanism in the Pudong where parties involved in foreign-related commercial disputes can autonomously agree to apply specific arbitration rules within the Pudong, with designated arbitrators to arbitrate related disputes.

[Robert: this essentially means you can apply foreign laws for arbitration in Pudong]

建设国际人才发展引领区,支持符合条件的外籍人才担任中国(上海)自由贸易试验区及临港新片区、张江科学城的事业单位、国有企业法定代表人,允许取得永久居留资格的外籍科学家在浦东新区领衔承担国家科技计划项目、担任新型研发机构法定代表人,吸引全球高层次人才牵头负责科技创新项目。Construct a leading zone for international talent development, supporting qualified foreign talents to serve as the legal representatives of public institutions and state-owned enterprises in the China (Shanghai) Pilot Free Trade Zone, the Lingang New Area, and the Zhangjiang Science City. Allow foreign scientists who have obtained permanent residence qualifications to lead national science and technology plan projects in the Pudong New District and serve as legal representatives of new research and development institutions, thereby attracting global high-level talents to take the lead in science and technology innovation projects.

[Robert: this is the equivalent of United States allowed a Chinese citizen to lead Fannie Mae, or OpenAI]

支持中国(上海)自由贸易试验区临港新片区探索建立安全便利的数据流动机制,允许在符合法律法规要求、确保安全前提下提升数据跨境流动的便利性。Support China (Shanghai) Pilot Free Trade Zone Lingang New Area to explore establishing a secure and convenient data flow mechanism, allowing for the facilitation of cross-border data flow under the premise that it complies with laws and regulations and ensures security.

[Robert: I have heard rumors that Lingang of Pudong has the ambition of turning Lingang into a “data processing platform” whether data can be easily “imported” and “exported”. Interesting and bold idea if it’s true.]

支持在中国(上海)自由贸易试验区临港新片区建设全球离岸创新基地,探索主动融入全球科技创新网络的“离岸支点”机制。Support the construction of a global offshore innovation base in the China (Shanghai) Pilot Free Trade Zone Lingang New Area, and explore the mechanism of an "offshore fulcrum" that proactively integrates into the global science and technology innovation network.

[Robert: This is another interesting idea that essentially apply foreign rules for a Chinese territory. A scientific enclave. This could also be one of the answers to the connundrum that China’s social and political system is not the best for scientific innovation.]

(I think you can roughly guess why I think people like Noah Smith are clueless. They operate with too much ideology but do not pay attention to details and on-the-ground facts. Sitting in the comfy chair of a developed economy and an advanced society, they also hold the unhealthy view that good things can happen in an instant, not through trials and errors and pains, even for a massive country like China. Again if you are interested in knowing more, vote Yes for the poll above)

the honorable mentions

#5 UK pianist incident

A viral video created a lot of waves on social media this week. I assume you have already seen it so I won’t describe it in detail. This video is painful to watch. There are so many things that get wrong on both sides, resulting in an epic clusterf**k.

I thinkPhil Cunningham of China News had the best writing on this episode:

The testy volley of words perfectly encapsulated the media tropes of nationalistic propaganda in the PRC in which the Chinese are posited as a proud and superior people who must be on guard against Western humiliation, as they had only recently overcome the indignity of a century’s shame and humiliation, which of course dates to the infamous bullying by Britain of China during the Opium War.

The St. Pancras incident was like 150 years of history packed into half an hour, and not just on the Chinese side. The piano player, Brendan Kavanaugh, deployed the cultural tropes of his own background and the rich fount of tropes of being Irish in England and outspoken in his pride of living in a free country, and more generally, seeing himself as part of a larger Anglo-American “free world”

“This is a free country” is a neat encapsulation, if not deliberate weaponization, of a political tradition dating back in the mists to the Magna Carta, the rise of democracy and the fiery oratory of the likes of Winston Churchill. Kavanaugh thus invoked the historical baggage of his own history in an edifying way, standing up to bullying, standing up to being told what to do, rejecting communism and celebrating the freedom to be free.

(By the way, I am an admirer of Phil’s newsletter China News, which consists mostly of his satirical pieces on Xinwenlianbo, China’s 7pm prime-time flagship news TV program. I don’t agree with many of Phil’s positions and opinions, and I don’t think the Xinwenlianbo is that relevant today since not many people actually watch it as we used to do. Many people in China know that it’s more like a political ritual, rather than an actual news program in the sense that we understand. But still, I love his style and writing, some of which are downright hilarious. And his criticisms of China are among the sharpest and most-to-the-point ones, coming from a long history of actual interactions with all walks of life in China, not something the Noah Smith type can easily emulate)

To me, this is a tragic case of mistranslation and cross-cultural communication breakdown. At the same time, the way the Chinese group talked with the Irish pianist lacked cultural sensitivity. Unlike Phil, I don’t necessarily attribute this to the “century of humiliation” vibe, but more like the “Tianxia syndrome” that I talked about last time when I critiqued Noah Smith: over-confidence, patronization toward others, with the assumption that what we take for granted should be accepted by other people without questions. “How could this foreigner not understand this simple request of us?”

On the other hand, Brendan Kavanagh also represents the mainstream Western attitude towards China in that he could easily jump to an ideological explanation for a simple communication breakdown, with the assumption that Chinese are very easily pawns for state and party apparatus.

We should all start to learn each other’s languages. Otherwise, more and more of these kinds of confrontations will happen, at a much bigger scale. That’s precisely my mission for this newsletter.

I wouldn't have banned you, which I agree is very petty, but I also would suggest re-assessing your comment and whether it accomplishes what you want it to. It's clear you've taken offense by Noah's analysis here, and that emotion is dominant in your tone. Instead of disagreement though, your comment comes off as an accusation -- that Noah is pushing false narratives with malicious intent. "I really ponder what you are trying to do here and what the assumptions you hold". I personally see ignorance more than malice. I think the emotion in your comment and the accusatory nature of it is likely what Noah objected to, and I think I do too, at least a little bit. For people who aren't familiar with your work, your comment doesn't read as an invitation to learn something new, which is a shame because I agree that his analysis on China is missing firsthand experience and a criticism of his work that incorporates that info would enrichen the whole debate! Looking forward to the takedown(s) -- would love to have your voice alongside his.

Great piece today, Robert.

Quite thin-skinned of Noah to ban you for a hundred years instead of engaging w/ your reasonable comment. I look forward to all your future posts on what he gets wrong about China. Your description of his takes on China being 1) wrong & 2) representative of many American intellectuals is spot on. I have seen many “thinkers” of this type (& their followers) being dismissive of taking feedback/input from on-the -ground PRC-based Chinese folks who they may actually learn something useful from. I have a few guesses as to why . .

Incidentally, I’ve heard something similar to your Lingang data comment recently. I’ve been to Lingang a couple times over the past years and got a sense that the area was set to do something different than other “new areas.” Will be interesting to see what happens.