Seismic changes in China's consumer psychology (shown by an epic corporate battle), Middle East money in China, court paper disclosures, stock decline continues - Week in Review #8

Hi everyone. Today’s post will be quite long. But I promise it will be worth the read. Today I will cover:

An epic, historic corporate battle at one of China’s largest education/live-streaming e-commerce companies and what it shows about the seismic changes in China’s consumer psychology

Big debate about court paper disclosures and why this matter is so important for the economy

Shanghai stock index broke below another key psychological threshold of 2900, despite the “bright prospects” urging from the CEWC

New and big money from the Middle East into China market

(very briefly) Draft video game regulation

Again, for why I write, please check here. For who I am and what new things I can bring on the table, please check here.

the profound

#1 CEO vs KOL epic at East Buy

Last weekend, the whole China internet was enthralled by a big corporate drama at East Buy (stock code: 1797.HK), the live-streaming e-commerce arm of New Oriental Education (EDU.US), itself China’s largest education group.

During those days, almost every day I woke up to a stream of latest information about this incident, to which the stock prices of East Buy, EDU, and even competitors such as Gaotu (GOTU.US) zig-zagged wildly. For a business story, in my recent memory only the OpenAI corporate battle could mirror this one in terms of drama, intensity and the level of attention. Not even the 2015-2017 Vanke hostile takeover drama could rival this one.

I understand this event is poorly understood and under-covered in the West because of unfamiliar context. But because the whole nation was literally glued to their phones for this, you MUST understand its significance, as I believe this event marks an important watershed moment in Chinese consumer’s psyche, of historic proportions.

First, what happened?

Let me try to explain this complicated event in 5 short paragraphs. Afterwards I will show you its significance in 4 simple questions.

In 2021, in a shocking move, the Chinese government banned all after-school tutoring for students enrolled in primary and middle school (typically 6-15 years old) in core subjects such as Math, Chinese, and English. The whole sector was wiped out overnight. Amid the rubbles of this disaster, EDU, the industry pioneer, like phoenix arising from ashes, managed to grow into other business areas, including non-core academic programs and live-streaming e-commerce.

The live-streaming e-commerce business, named East Buy东方甄选, became an instant success upon its launch in early 2022. The public face of this transformation is a small-framed, square-faced young fellow named Dong Yuhui. What Dong lacks in his look, he more than makes up in his speaking charm. Previously an English tutor at EDU, Dong has become a sensation for his unique style of mixing English education, Chinese poetry, deep knowledge of literature, cultured taste and, well, selling stuff. In a business where most influencers are known to resort to high-power selling antics to attract sales, Dong’s cultured and authentic style is unique and also highly effectively. For example, in one of his shot-to-fame moments on June 9 of last year, he taught history lessons and Harari’s book Sapiens, in order to sell a bag of rice.

Now Dong, aged 30, is the leading influencer of East Buy and has played a pivotable role in transforming the East Buy, previously known as Koolearn, into a multi-billion dollar-worth franchise. But as East Buy became more successful, so did the perceived conflict between Dong and the company. Nominally, Dong is only an employee of East Buy, but as far as the public is concerned, Dong is the person who actually deserved most of the credit. Dong has become a star that has outshone the company he worked for. For any normal business manager in such a situation, they must strategize about diversifying away from over-dependence on any single person. So there has been consistent push at East Buy to cultivate more influencers like Dong, but so far nobody has yet reached Dong’s stardom.

Under this background, the conflict erupted last week. It started with a fairly innocuous public post made by the official account of East Buy, explaining to fans that actually Mr. Dong’s speech is not just his own work, but the collective effort of a whole team, including the “little editors小编” behind. Dong’s fans quickly challenged this assertion, and the motives behind this kind of statement. It quickly spiraled into a bitter argument between East Buy’s official account and fans, creating a big spectacle. Hundreds of thousands of fans “cancelled”. East Buy’s sales took a major hit. CEO of East Buy, Mr. Sun Dongxu made a public appearance, but instead of pacifying fans, he exacerbated the problem, which made the public realize this might not be a simple case of a back-stage editor running rogue but something deeper was brewing. By that point, things went out of control for East Buy. Mob of fans cancelled at East Buy and rushed to competitor Gaotu, also an education-turned e-commerce company. Gaotu’s stock price doubled in a few days, while East Buy and EDU tumbled, wiping out close to a billion-dollar-worth of value.

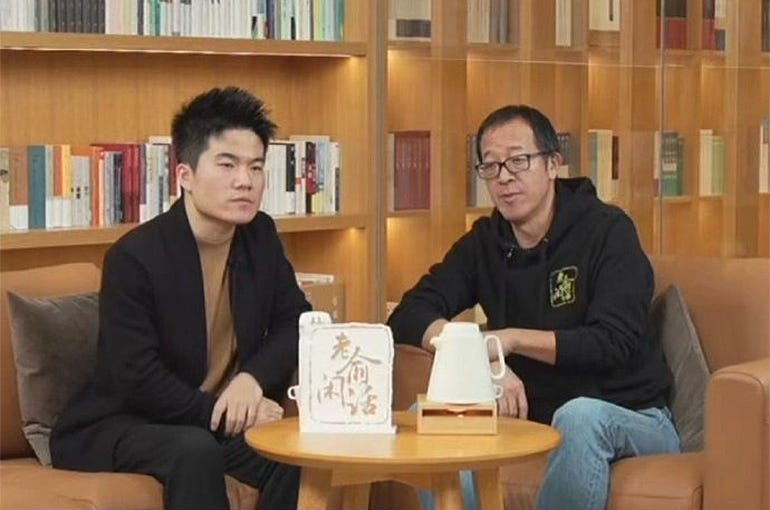

By weekend, public is demanding EDU’s largest shareholder and ultimate decision maker, Mr. Yu Minhong, a famed entrepreneur himself, to make a choice between Mr. Dong and Mr. Sun. The dice was cast on Saturday, with Mr. Sun sacked as CEO, Mr. Yu taking on as interim CEO. Mr. Dong was promised with a big package, a new title as vice president, and an autonomously run live-streaming studio under his own name. Then Mr. Yu and Mr. Dong made a series of public appearances together. Mr. Dong looked tired and grateful. He said this event was shocking to him as well, that he loved EDU and East Buy and Mr. Yu. Although he could make much more money elsewhere, he would stay at East Buy. He quoted an ancient saying, “a noble person dies for kindred spirit士为知己者死”. The public was overall pacified.

Significance of the Dong Yuhui incident in 4 questions

There are many important questions about this event, and each one of these points can help you to understand the real significance of it.

Question 1: Why was Dong successful in the first place?

This was totally unexpected. Live-streaming e-commerce is a wild place in China, where crazy people get fat rewards. It is eyeball economy both at its crudest and finest. The successful ones have to go full Steve Ballmer-mode. To have a taste:

When EDU first waded into this business, nobody expected them to be so successful. Because, after all, how many sales can a bunch of teachers/intellectuals achieve anyway? Traditionally, being an intellectual doesn’t make good money. They are too shy, and think too highly of themselves. Even the EDU team themselves did not have much hope. Remember, at the time their original business was severely shut down and they were just desperate to find a way out.

But it turns out, blending good culture, high taste and selling stuff is actually a good business. Suddenly, people realize that many Chinese consumers have evolved to a mature stage, where sustainable emotional value and learning matter a lot more than before.

Question 2: Why the incident created such a storm?

This is as expected, because Dong has become a national star. But the extent of this storm is still quite shocking for many people.

Although we all know Dong was successful, this incident made us realize he was this successful. Clearly, this shows that the style he represents is not just a fleeting phenomenon, nor a niche taste. It strikes the cord of vast number of Chinese consumers, especially the urban consumers. And he is not an isolated phenomenon. A few months ago, at Baiguan we talked about another influencer, Teresa Cheung, who also blended culture and commerce, and became a leading player on the Xiaohongshu platform.

Cleary, if you are a consumer company or an investor of China’s consumer market, you shouldn’t ignore this. The ground is clearly shifting. But to which direction?

Question 3: Why was Dong saved, while CEO Sun immediately sacked?

This is actually predicted by many people. Without Sun, East Buy can always find another CEO. But without Dong, most of East Buy’s value would be wiped out.

Still, this is a rare event where a star employee is chosen, in favor over the big boss, something quite unthinkable in an East Asian society like China, where obedience is important.

In fact this is also another reason why this event has became so huge: a lot of people, who themselves are corporate employees and have their share of grievances, identify themselves with Dong. Now, this event tells everyone that the old manager-employee relationship is up for some rethinking. If you are important enough, an employee can sack the boss.

This spirit of rebelliousness is here to stay.

Question 4: Why Dong chose to stay in East Buy in the end, even though he publicly said he would earn much more elsewhere?

The final twist of this event is also what I think the most important one.

Let’s take a step back. Think of Dong as the brightest star in the largest e-commerce industry on earth. From the public’s perspective, it’s not unthinkable to make Dong a big equity owner of the company along with an astronomical pay package. In fact, there are no shortage of other e-commerce companies who are willing to pay hundreds of millions to poach Dong. In a totally “rational” world with complete market economy logic, that’s how things will end up. But there is also no way for East Buy to match the real value of Dong, without handing over majority of interests to him and dramatically diluting other interests. So in a purely capitalistic logic, Dong Yuhui should just quit East Buy and chase whatever role that can maximize his value.

But Dong refused it. In his own words:

In my communication with Teacher Yu, I can feel I have been respected and listened to all along, and this is important than any money. To be honest, if I only care about more pay, I would have left as early as last June. I have received many jaw-dropping offers. But I have to think about the actual value and meaning of my work. When I am old, how will I remember my life?……I don’t want my life to be a story of getting famous and becoming a sales champion. I know the world has given me many opinions, but I have to keep my own opinion. I have to do things that I identify with. Books, culture, agricultural products, when I work with these things it makes me happy.

A noble person dies for kindred spirit. If he can understand you, you will think your work is meaningful. You will be happy. To me, happiness, good sleep are more important than money. People who know me know that I have distress disorders. Especially since last year when I suddenly became famous, I have had very bad sleep. I often only got to sleep at 6-7am, and constantly rely on medications. You may feel that I am already a different person than last year. Compare with the charm I had last year, I am much slow now. So, happiness, good appetite and ability to sleep is No. 1 for me. Today when I left Xi’an to come here, my mother only said to me: have good food and good sleep.

A huge luck just landed on me, a village kid. My parents are still farming. Even my grandma, who is already 80 years old, is still working on the farm. This is why I always run back home during break. Getting close to soil reassures me. You eat what you sow, and there will always be misfortunes, so you have to keep optimistic. Soil can really teach you a lot of wisdom. It may be old and conservative, but it is definitely classic and true.

Those words from Dong, and his whole success story capture the real significance of this episode: Chinese consumers, or at least a substantial chunk of consumers, are drifting towards meaning-based choices.

In a purely consumerist culture, you should just get more and more stuff, at forever cheaper prices. But now, we are shown a live example that “getting more” is not the only answer. Now, meanings matter. Culture matters. Spirituality matters. Looking inward matters. Inner peace matters.

There are many other examples. Many of the consumer trends we have observed this year center around this new age of spirituality. It’s just amazing to see those trends erupt and get personified in this single man.

#2 Big debate about court papers disclosures

This past week has another event that I think is as profound as the Dong Yuhui incident.

A big debate is going on right now about whether the government should keep publishing court ruling documents. Disclosure has been the norm for the last couple years, through a website called “China Judgements Online中国裁判文书网”. For some reasons, the number of court documents published on the site have plummeted over the last few years, causing concerns from legal circles. To add fuel to the fire, a recent leaked document showed that Supreme People's Court would launch a new platform which would only be accessible by court employees. It is widely feared that the original public site will stop service. For obvious reasons, such move has caused quite an uproar.

One of the most impactful pieces, which I think is also the best written is the one titled “Why and how is court ruling disclosures important for boosting the economy对提振经济,公开判决书为何重要,有多重要?” The article was published on Dec. 18 and has been shared widely. It has not been censored as the date of writing this post. The article is interesting in the sense that it clearly links this matter, which is an otherwise purely legal matter, to the most pressing issue of the day: boosting economy and business confidence.

This discussion is very relevant. It is essentially part of the wider debates that are helping to set the tone on what Central Economic Work Conference (CEWC)’s “expectation management” really means. I have iterated again and again that the key for re-installing business confidence is through a re-iteration of rule of law. I will discuss in more detail in the section below.

Interestingly though, the debate has been very much left uncensored, showing that this policy move probably only come from certain part of the government, especially People’s Supreme Court, but does not represent the will of highest level of power yet. If the debate is fierce enough, it is likely to be retracted or modified, the same way when China Administration of Cyberspace (CAC) took a U-turn on AIGC regulation earlier this year.

As I argued before, gauging public sentiments as well as censor’s reactions to them (instead of imagining China to be a single dictatorial monolith) are a great way to really understand policy movements in China.

[Note: most of today’s post was written mid-week. At the date of publishing this post, Supreme People’s Court (SPC) issued a long, formal explainer document to address this debate (linked article by

of ). As predicted, SPC looks strongly concerned by the public opinion. They formally clarify that new private database is a standalone system and the original public site is not to be taken down. They address the problems of “disappearing documents” head on, by blaming on operational inefficiency and privacy issues. For instance, they cite many complaints made by individuals and businesses for creating troubles for their families or business prospects because of excessive disclosures. Still, this explanation begs the question why they can’t improve on the old site but have to start a new one. But at least they publicly commit themselves to the principle of transparency, and their tone sounds candid. I see this as a mini-victory.]the interesting

#3 Shanghai stock index broke below another key psychological threshold of 2900

As winter chill swept across China this week, there seems to be no end in sight for the chills in China’s capital market.

After the “Battle of 3000 points三千点保卫战” was lost last week, a new “Battle of 2900” is launched for the Shanghai index, and there is no assurance that the battle can be won.

This does not look good for the CEWC which was concluded just last week.

Or, maybe, it is just a result of CEWC. Specifically, some wordings, such as “promote a positive narrative about the bright prospects for the Chinese economy” and “Urging stronger confidence” of CEWC have caused more confusion rather than optimism for the market.

When those wordings first appeared, I at first felt hopeful that finally the government realized the importance of confidence. But I also warned that the devil is always in implementation. Without good implementation, it can only makes the matter worse. Government needs to realize that confidence can’t be dictated. As I argue above, if you really make the rules clear, make information more transparent and stop being arbitrary, confidence will flow back on its own. This is especially true when, as Mr. Shan Weijian of PAG pointed out, the fundamentals of economy is actually okay. But heavy-handed policy guidance can only serve to squander these good fundamentals.

I can’t state what’s at stake here as well as Mr.

, ex-Chief Editor of SCMP, who wrote a wonderful column on his personal substack (emphasis my own) :“Urging stronger confidence” has become another buzzword. How is China meant to achieve that? Evidently, more efforts should be made to “strengthen economic propaganda and public opinion guidance, and promote a positive narrative about the bright prospects for the Chinese economy”.

This gives the impression that there is nothing seriously wrong with the economy, but that the country’s propaganda machine has done a poor job. Chinese state media are already saturated with glowing reports and commentaries about the bright prospects for the economy.

The new directive seems to target online commentators and analysts who write research reports for clients at brokerages, consultancies and think tanks. Many online pundits have already seen their social media accounts suspended because of their frank and honest comments, and analysts have been warned they must be careful in their choice of words when writing about the Chinese economy.

One Hong-Kong-based fund manager told me that when sales people from Chinese brokers come to meet him, they first flash PowerPoint presentations on the bright prospects of the Chinese economy. After the presentation, they go on to share what they really think.How is it possible to restore confidence if one has to be economical with the truth? No wonder the stock markets in Hong Kong and on the mainland fell on Wednesday, the first trading day after the work conference statement was released.

the under-reported

#4 Middle East money flows into China

Still, there are some interesting good news to cheer for this week. CYVN Holdings, an investment fund controlled by the Abu Dhabi government, has invested US$2.2 billion in Nio, China’s leading electric vehicle. This came after the same entity subscribed for $1.1 billion of new shares for Nio back in June, boosting its total stake to reach over 20%, making it easily the single largest shareholder of Nio.

And it’s not an isolated event. Earlier this month, Qatar Investment Authority purchase a 4.26% stake at Kingdee, China’s leading ERP software company (0268.HK) for $200 million, in a move that has surprised many people back then. PIF, Saudi Arabia’s sovereign wealth fund has also announced recently that it is setting up China office.

This steady fund flows from the Middle East tell us it is not simply a story of foreign capital fleeing China, but looks more and more like an Eurasia undergoing a reconfiguration of economic interests - and eventually a multi-polarization of capital and investment.

And it’s not just a one way street. Another big story of last week is how China’s ByteDance resolved the their own crisis in Indonesia, by creatively investing $1.5 billion into a merged entity between local player Tokopedia and TikTok Shop Indonesia. (Check this excellent analysis by

, ex-Bessemer investor, now an entrepreneur)It is also worth noting that historically, it was capital from non-Anglo American investors that reaped the biggest alpha from China’s growth. For instance, it was South Africa’s Naspers who backed Tencent more than 2 decades ago, a deal of the century that created over $100 billion new wealth for this investor. It was Mr. Masayoshi Son, a Japanese, who got the most out of his single largest shareholding by supporting Alibaba.

Among the top Chinese electric vehicle players, Nio is famous for belonging to the boldest type. It has built a massive battery-swapping station network across the nation, which is very costly, leading to persistent bankruptcy fears for themselves. But if Nio can survive bankruptcy risk, it could also profit massively by setting a new industry standard. It’s really a high-risk, high-reward play. So now if Nio can make it, it would be Abu Dhabi’s turn to reap the most rewards.

the honorable mention

#5 Draft video game regulation

Just as I am finishing on today’s post, a bomb landed on my desk. SCMP:

The National Press and Publication Administration said online game players should not be rewarded for logging in daily and all online games should set top-up limit and warn users about irrational consumption behaviors, according to a draft published on Friday.

This has created havoc for the market, slashing stock price of market stalwarts like Tencent. It is definitely not helpful for the Battle of 2900.

What did I just say? You can’t expect to have confidence if you just keep throwing policy bombs when people are super nervous.

But, I also don’t think the people who made this draft predicted what huge impact it had on sentiments. If my previous theory also holds, such strong reaction from the market may also help to dissuade policy makers from putting such draft into reality…

I have not enough time this week to comment on this news, but will wait and see if I can get more to say for the next week. For now, let me conclude this week’s correspondence, and I wish you and your family a Merry Christmas!