Last weekend, buried in all the chaos about Israeli-Iran conflicts, one significant news item about China went almost unnoticed.

The renewed U.S.-China trade truce struck in London left a key area of export restrictions tied to national security untouched, an unresolved conflict that threatens a more comprehensive deal, two people briefed on detailed outcomes of the talks told Reuters.

Beijing has not committed to grant export clearance for some specialized rare-earth magnets that U.S. military suppliers need for fighter jets and missile systems, the people said. The United States maintains export curbs on China's purchases of advanced artificial intelligence chips out of concern that they also have military applications.

At talks in London last week, China's negotiators appeared to link progress in lifting export controls on military-use rare earth magnets with the longstanding U.S. curbs on exports of the most advanced AI chips to China. That marked a new twist in trade talks that began with opioid trafficking, tariff rates and China's trade surplus, but have since shifted to focus on export controls.

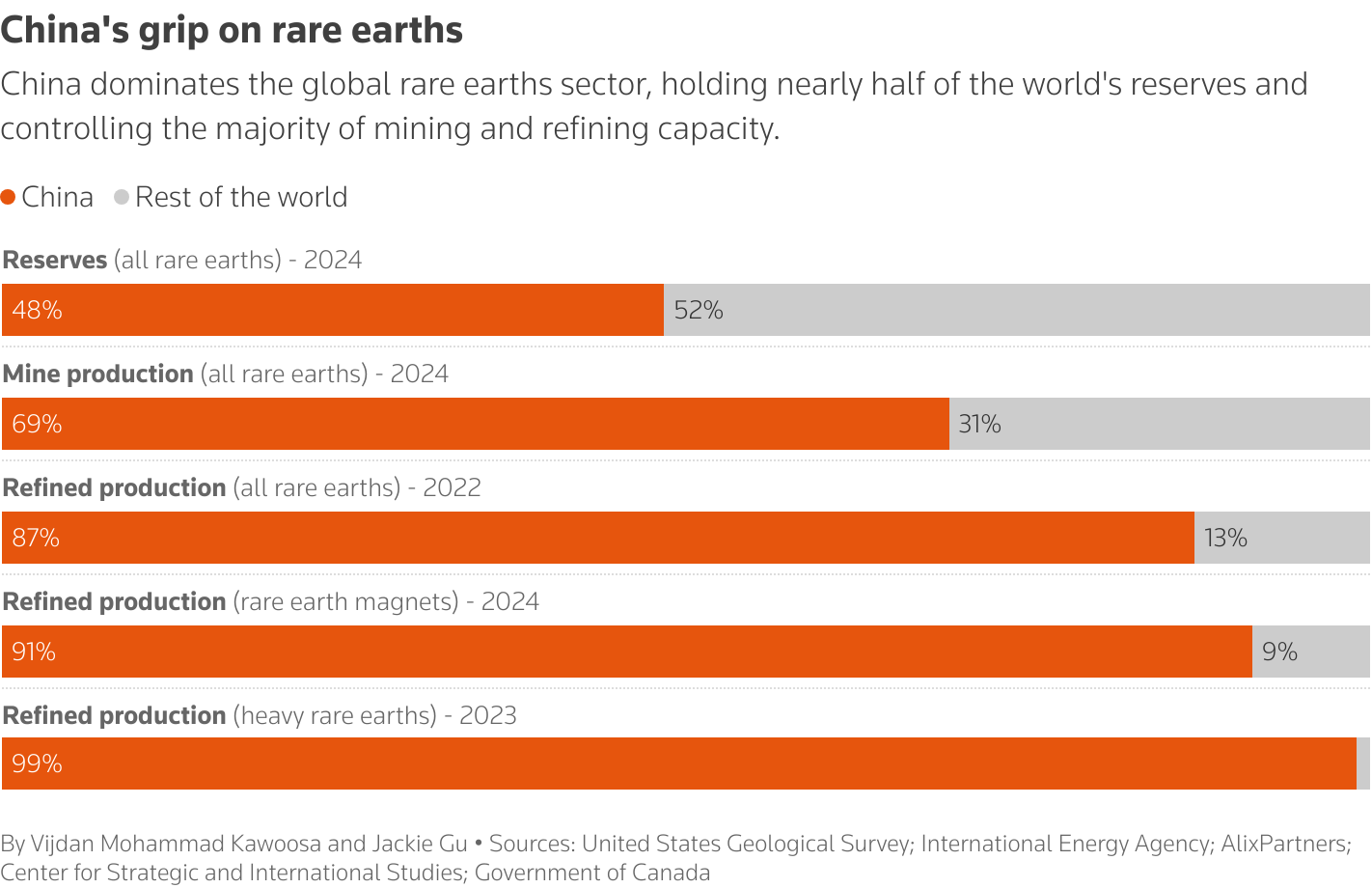

I also love this chart put up by Reuters:

This piece of news makes a lot of sense, and suddenly my puzzlement at the mysterious “framework of a framework” ending of the “London talks” is resolved.

Up until this point, the US-China trade war has mostly centered on tariffs and goods trading, but what happened after April 2 had little to do with semiconductors. Most of the export controls related to chips have been in place since the Biden era. So why would China want to bring up this demand at this point?

This new twist points to the last-resort nature of bringing rare earth metals to the negotiating table for the first time in history.

Rare earth metal is an ace card. It has the potential to create massive supply chain disruptions for high-end manufacturing, especially the defense sector. In the meantime, embargoing it means a much smaller cost to China than an embargo of general goods. Judging by the urgency for Trump to call Xi and to make London talks happen, this highly asymmetric “weapon” has proven to be quite effective.

But the risk for China is whether China is showing its hand too soon? Is China really at the direst moment when such a card has to be played? I don’t think anyone will have a sure answer for this. But given that this card is already out, it’s only natural for China to demand the maximum return for it, not to waste it.

Another interesting news item today is China’s surprisingly good May consumption data. Retail sales of consumer goods grew 6.4% y/y, up from 5.1% in April, continuing an upward trend since the bottom in the Summer of 2024.

The question remains whether this trend will continue, or if it’s just a one-time effect from the trade-in subsidy program.

My short answer is, it will continue. Over the following week, I will write a long piece about this topic at Baiguan - China Insights, Data, Context. I will take a deep dive into the longer-term growth potential for its consumer market, by drawing observations about recent events, ranging from Chinese EV maker’s pledge to shorten payable days to suppliers, to the fascinating Jiangsu City League that I covered at this newsletter, to the phenomenal rise of POP Mart and Laopu Gold. My analysis will focus on business profits and consumer excitement. So if you are interested, definitely subscribe to Baiguan.

Once again, paying subscribers of Baiguan are entitled to complimentary access of this newsletter. Just contact me and I will give you access manually.

One final word about the relationship between this newsletter, China Translated, and Baiguan. Some of my newer subscribers seem to be confused about this.

Baiguan is the newsletter operated by my company. Its main task is to provide data-driven, on-the-ground and contextualized insights about China’s business and investment opportunities. It’s for anyone who has a real stake in China. So if you are a stakeholder, be it an investor, a corporate executive with substantial China exposure, or your career is closely connected with China, Baiguan will be your go-to choice.

China Translated is my personal newsletter. The main goal is to make China start to make some sense to you. To help China make sense, it’s inevitable that I will touch more on politics, culture, and history, something I don’t want to be confused with my company’s project. I also tend to be much more blunt and could even be a bit controversial here than I could otherwise do at Baiguan.

But so long as I am with Baiguan, I will give away access to the paid sections of this newsletter for free to Baiguan’s paying subscribers. But I can only do so manually. I wish Substack could make this “bundling” experience much easier than it is right now. I even started an online petition to ask for it. It’s still live, you may express your support at Making Substack affordable for average folks.

Besides complimentary access of China Translated, paying subscribers of Baiguan can also access Baiguan’s highly active Discord community, where a lot of discussion about stocks, economy and geopolitics are taking place. Besides this, my team is also designing a more comprehensive “benefit package” for paying subscribers, including free trials and discounts at other high-quality newsletters. Definitely stay tuned there!

Israel's stand-off missile war with USA can only worsen the supply issues within the USA. It will be interesting to see where this all leads.