1 trillion new debt, Li Shangfu, Li Keqiang, MSS, Gavin Newsom, Evan Osnos, Micro Connect - Week in Review #1

Welcome to the first post of Lost in Translation 迷失南京, the personal newsletter of Robert Wu (aka Robert Woo). I am the CEO of BigOne Lab and co-editor of Baiguan, your go-to newsletter for data-driven and native insights about China.

My fundamental motive for also starting a personal newsletter is the same with starting Baiguan. I see too few people actively bridging the information gap between China and the West, in a way that’s contextualized, empathetic, informative and trustworthy. And I think this is increasingly a dangerous situation, because the rise of China is the most impactful geopolitical event of this century, but the world still only has a shockingly low level of understanding of this country. This lack of understanding (sometimes misunderstanding) will someday lead to catastrophes. I just have to do something about it. In short, I do not wish to lose our civilizations to bad translations. Hence the name of this newsletter: Lost in Translation.

Additionally, I personally have things to say that may not fit well with Baiguan’s editorial style or rigor, so I’d better not mix things up.

In Lost in Translation, I will give you my personal review of the most profound, the most interesting and the most under-reported events about China of the past week. I will touch on events related to economy, finance, domestic policy, social movements, discourses and very importantly, narratives. But I will try to shun topics related to elite politics, diplomatic and military affairs, which I know too little to say anything about. I will also heavily skew towards events that have long-term, structural implications, but will only lightly skim through even bigger headlines that only have temporary value.

Needless to say, views here are strictly personal, and do not represent views either of BigOne Lab or of Baiguan. If you want information that’s more directly related to investment and business opportunities (aka more relevant to making money), go visit Baiguan, it’s among the best in the market right now. If you have even more budget and want something more sophisticated, go to our company BigOne Lab.

The most profound

#1 1-trillion additional sovereign debt

I’d argue the most profound piece of news about China over the past week is the decision to issue 1 trillion yuan of additional sovereign debt. Looking at itself, it’s not such a big deal, considering there are ~RMB87 trillion local government debts outstanding right now. But the real significance is that by doing this additional new debt, the central government budget deficit ratio increased from 3%, long considered a red line, to 3.8%, a very rare thing to do with few historical precedents. It shows the government is quite concerned about the economy and has finally thrown some fiscal weight in order to boost confidence. This news, along with the market rumor that President Xi paid his first known visit to the central bank PBOC, and the news that state-owned asset body began aggressively pile into index ETFs, have sent a strong signal to market. The writing is on the wall: now the central government is finally going to spend some serious money to boost the market.

A popular finance influencer, 沧海一土狗 wrote on his WeChat, comparing this event to releasing of control rods in a nuclear power plant:

We do not need to be worried about the economic impact of this 1 trillion new debt. Its effect has to be huge…We shouldn’t see this 1 trillion as nuclear fuel. We should see it as the control rods. Now we are literally “pulling up the control rods” to stimulate the economy.

As a result, after sinking through the key psychological threshold of 3000 last Friday, Shanghai Composite Index climbed back up this week. Hang Seng also ended the week higher.

The interesting

#2 Ministry of State Security (MSS) publicly defends its position on Counter-Espionage Law

I have been reading every blog post of MSS ever since they opened their WeChat blog account earlier this year. Their account is usually notable for high-profile announcement of specific espionage cases, recount of some glorious episodes in CPC spy history, as well as typical party-building stuff. This is already very interesting, considering that fact the MSS used to be so secretive that it remains to this day the only government ministry whose vice-ministers are not publicly shown.

But recently their series of posts defending the Counter-Espionage Law (CSL) has been even more intriguing, in which they very publicly argued against claims that the CSL will lead to "generalization of national security," "impacting overseas companies," and "rising risks for foreigners in China."etc. It basically says that “foreigners who are not spies are safe in China”.

This is rare, and I think, a very positive development. For a long time, western commentators mention MSS in the same breadth of those infamous historical security service such as Gestapo or KGB. The bad men in black secretly doing some crazy dark shit. Now, it turns out that the “KGB” has opened a WeChat account and publicly defends its position. (So instead of comparing MSS to KGB, maybe a reference to CIA is more fitting now?) Overall, I believe there are some very capable and open-minded people at the top of the MSS right now allowing this kind of precedent-setting thing to happen.

It may also be a new paradigm for Chinese government’s strategic communication in the future. Mu and I stressed over and over again that a lot of problems about China’s governance arise from insufficient skills and talents, especially in the PR field. Now if the most mystic body can be so public, who else can have excuses? I have my fingers crossed here.

#3 Removal of Defense Minister Li Shangfu. Is it a “purge”?

The long-rumored removal of Li Shangfu was finally formalized. Li was removed both from his position as a State Councillor as well as the Defense Minister. (Qin Gang was also formally removed as the State Councillor.)

For the event itself I do not have much else to say. I think Bill Bishop of Sinocism gave a pretty fair assessment on this matter responding to a subscriber’s question on this matter:

if you mean the PLA corruption investigations I see it as less political —the people under investigation that we know about were promoted under Xi - and more about the inability to fully eradicate the longstanding problem of PLA corruption, especially when there is now so much more money to steal. i keep hearing that at least a dozen generals are under investigation as well as top execs of several of the big military industrial SOEs. in some ways this is actually quite helpful for the PLA, as if there is a big corruption problem that led to quality issues in some weapons systems then it is much better to find that out now before you try to use them

What intrigues me is how some western media frames this event. It comes down to the usage of the word "purge".

For instance, every time when Mr.Jordan Schneider of ChinaTalk talks about this, he always use the P word.

Why do I care about words? Because I believe language is not just a tool, but the story itself. Word is reality. Choosing and not choosing different words is a conscious choice to convey one’s beliefs, and will in turn affect other people’s beliefs.

I don’t know about you, but whenever I hear the word "purge", I think of the Great Purge of Stalin, where tens of thousands of party leaders and red army commanders were slaughtered. According to Britannica, “to purge” means:

to remove people from an area, country, organization, etc., often in a violent and sudden way

Was Li Shangfu removed violently? We do not know for sure. But most likely violence was not involved. And I am dead sure he was not killed. Heck I am not even sure if he has ever been arrested. So maybe a more accurate phrase is simply "removed", in the same sense when James Comey was removed from the FBI, or Kevin McCarthy was removed the speakership?

It is not hard to understand the motive behind choice of word here. If China is “purging” someone, without specifying whether it’s violent or not, it just adds to the perceived cruelty and brutishness of this country.

Or if you insist someone can also be purged non-violently, maybe you can state that "General Li Shangfu was purged, possibly non-violently”? Definitely sounds more accurate this way, albeit a little too heavy-handed.

[I also have another favorite word to attack, which is "genocide", but I will save this fun for another time.]

#4 Evan Osnos’ New Yorker article

Evan Osnos’ China’s Age of Malaise article is creating some big waves among China-watching community. I’d say Evan Osnos perfectly and beautifully captured the collective ethos of China’s intellectual elites. 95%+ of such kind of elites around me in China embrace that ethos. They are not happy about the last few years.

The many criticisms on this article (e.g. Mu, Glenn Luk, Taisu Zhang) surround that, by focusing only on the opinions of the 1%, not the masses, Mr. Osnos is really just telling the story of a niche group, a tiny portion of the total population, and making a doomsday extrapolations based on this niche group.

I fully agree with this line of criticism. And to it I just want to add one more thing, which I will repeat it over and over again for you in the future:

The people outside of China who are interested in China are necessarily elitist. Because, if you are not an elitist, you have no reason to care about China.

Now, being an elitist, the common peril is always this special information cacoon around ourselves. Because it is only elitists who are able to coherently express ourselves, and we do express profusely, while the silent majority is just, silent. In the end, if we are not careful, we will just forever swim in the echo chamber of our own.

On this topic, I am super curious to know what Peter Hessler, also an illustrious fellow New Yorker writer, would write about. His many works, such as River Town, is a classic example of actually breaking through the elitist echo chamber.

The under-reported

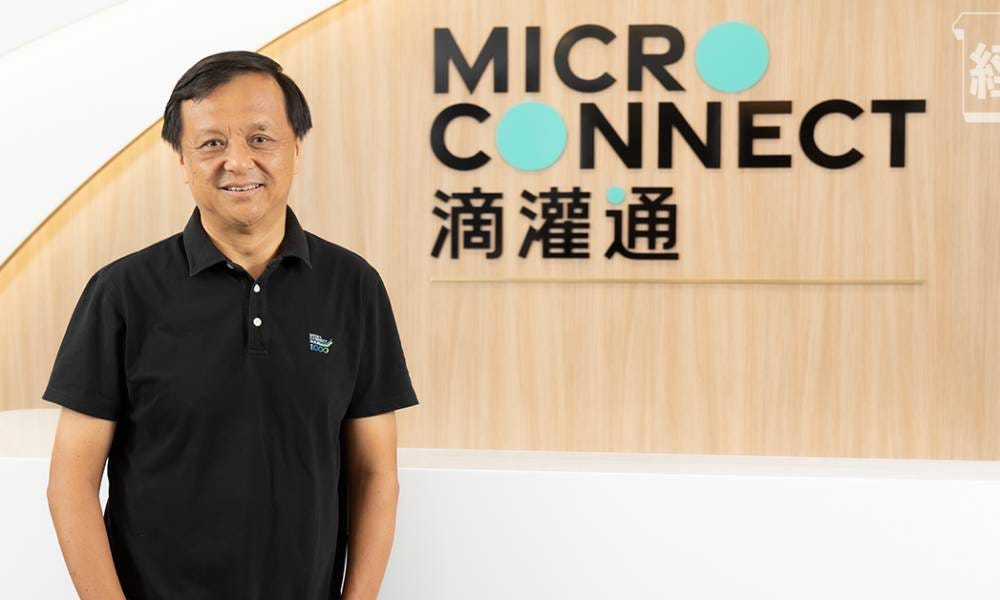

#5 The Micro Connect controversy

A very important but under-reported story is the on-going controversy surrounding an innovative fintech company called 滴管通 Micro Connect.

Micro Connect was founded by Mr. Charles Li李小加, and backed by many of Hong Kong’s tycoons. Mr. Li is the former CEO of Hon Kong Stock Exchange (HKEX). There, he was responsible for many profound reforms of national importance, including the revolutionary Hong Kong-mainland Stock Connect mechanism, now a main channel for RMB to invest across the border.

Full disclosure: I am a big fan of Charles Li. He is a real legend, an oil-rig worker turned investment banker turned CEO of HKEX. He is a tough guy with lofty dreams and resourcefulness to put dreams into reality. He is the real deal, making real achievements for the world. Incidentally, he also has a strong sense of humor.

After an impactful career at HKEX, he founded Micro Connect with a bold concept: SMEs in China are too small to raise equity funding, and debt funding is both draconian and expensive. Why not use high-frequency data to find the winners, and to provide them with funding that is neither equity nor debt, but a cut of actual profits, repaid out of each day’s daily revenues (called Daily Revenue Obligations or DROs)? Micro Connect even partners with Macao to develop the Micro Connect Macao Financial Assets Exchange, through which overseas investors can invest in those DROs in real time.

It’s also quite romantic. After making reforms to make nation’s most prominent companies such as Alibaba to be able to list in Hong Kong, now Charles Li is setting out to create a whole new way for China’s SMEs to get listed. Charles just never stops dreaming.

But this week, Mr. Song Xiangqian宋向前, a prominent China venture capitalist, launched a searing attack on Micro Connect’s business model. Mr. Song’s key argument is that the actual financing costs of Micro Connect is quite high and the embedded risks have to be paid attention to. He even likens Micro Connect to “Peer-to-Peer lending”, or P2P, a harsh word almost synonymous with “fraud” in China now because of bad experience back in 2016-2018. This criticism creates a lot of controversy, to the point every business-related WeChat groups I am part of are debating about this. Even Charles Li himself has just given a strong rebuttal through interviews.

Micro Connect is not free of problems, and I will not go into the specifics to defend it. What I want to stress is that, this type of controversy is ultimately good for Micro Connect. It shows that Micro Connect has finally become a real force to be reckoned with. And if Charles Li ever succeeds again, it will be a game changer for 1) how China’s small and medium businesses get funding and 2) another important asset class for overseas investors to share China’s growth.

Definitely stay tuned here. It may be huge. (They have a substack too, China Consumer Connect )

The honorable mentions

#6 Li Keqiang’s death

Just when I think this week has been eventful enough, I woke up on Friday morning to a bomb: former Premier Li Keqiang, who just retired this March, was dead, at age of 68, in the same city I live.

It’s a delicate moment. And I am sure it will be a hot topic in the next few days. However, aside from the shock value, I don’t think this is going to be a profound event, and that’s why I only include this as an honorable mention.

I just want to add one observation here. Premier Li always struck me as a 印堂发黑 guy, a traditional Chinese medicine saying about a person’s complexion that is darker than it should be, usually a sign of cardio-vascular unhealthiness, possibly due to stress, overwork and/or smoking. This, along with the rumor that he had a heart attack during swimming, makes the sad event quite believable.

My takeaway is, stay healthy, find the right balance between health and work. RIP Premier Li.

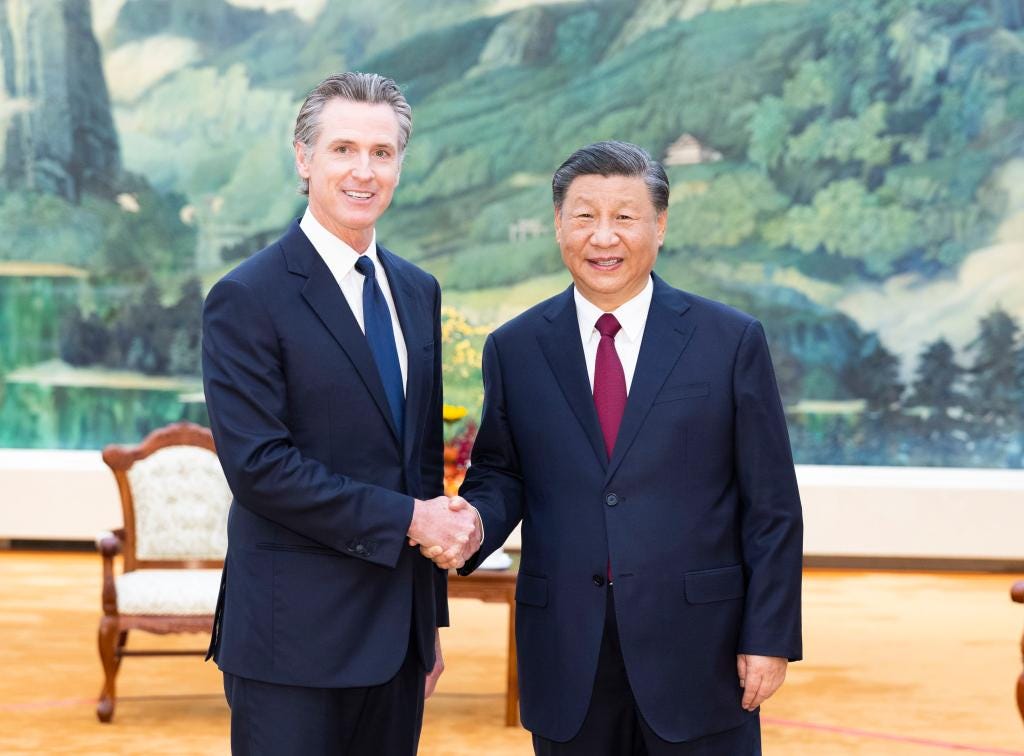

#7 Gavin Newsom meets Xi

It is intriguing that Governor of California got to meet Xi in person and got a nice photo op. But considering Gov. Newsom is the head of the world’s 4th largest economy, meeting the head of 2nd largest economy is not so shocking now, isn’t it?

(End)

Stumbled on this newsletter from your article on Li Auto from earlier this year. Great insights and look forward to learn more.

Thanks, thought-provoking post. You mentioned Micro Connect’s potential but also problems - briefly, what do you think those problems are?